California Mileage Rate 2024. Employees can sue their boss for failing to reimburse them for mileage. In california, employers are required to fully reimburse you.

So if one of your employees drives for 10 miles, you would reimburse them $6.70. Effective january 1, 2024, the following mileage reimbursement rates apply:

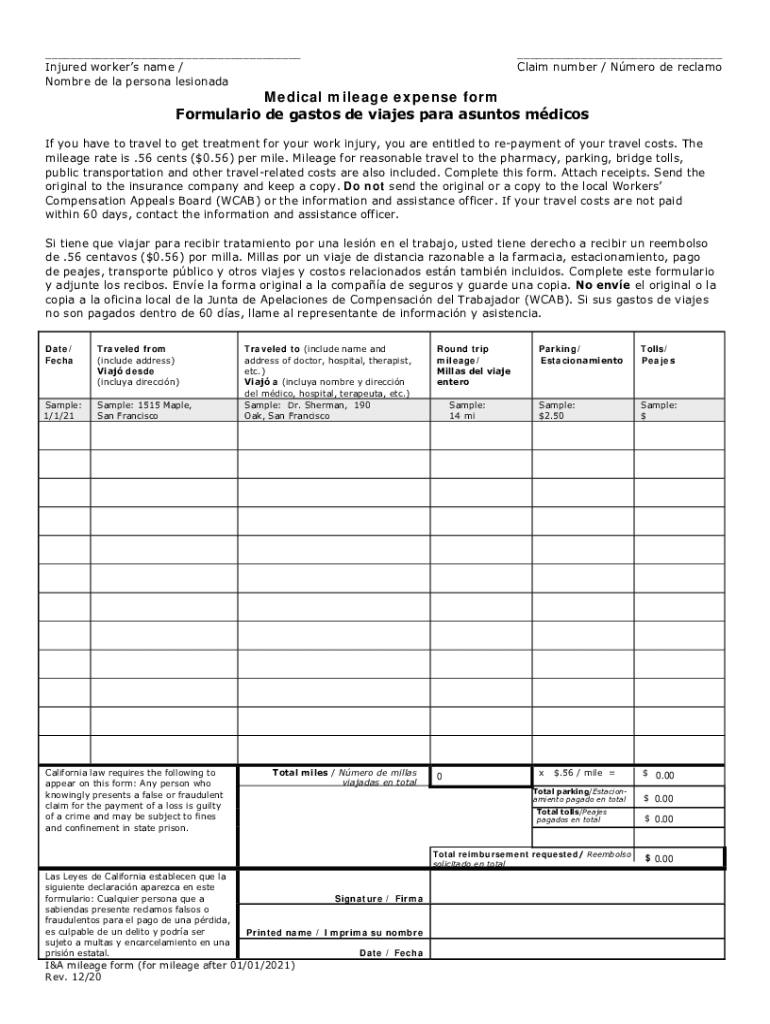

California mileage verification form Fill out & sign online DocHub, While minimum wages are increasing, the irs gave employees who drive for company business another present this holiday season: Effective january 1, 2024, the following mileage reimbursement rates apply:

California Employers and the IRS Business Mileage Rate for 2023 Ethos, Fy 2024 per diem rates for los angeles, california. Find out when you can deduct vehicle mileage.

California Mileage Reimbursement Requirements Explained (2023), The irs bumped up the optional mileage rate to 67 cents a mile in 2024 for business use, up from 65.5 cents for 2023. January 30, 2024 10:18 am.

2023 standard mileage rates released by IRS, Beginning on january 1, 2024, the millage rate for reimbursement for business use will increase to 67 cents per mile. The maximum standard vehicle cost is the maximum standard automobile cost for 2024 is $62,000.

IRS Announces 2023 Standard Mileage Rates Marshfield Insurance, The irs mileage rate in 2024 is 67 cents per mile for business use. Moving ( military only ):

Free Mileage Log Templates Smartsheet (2023), The irs mileage rate in 2024 is 67 cents per mile for business use. The california state university mileage rate for calendar year 2024 will be 67 cents per mile, which is an increase from the 2023 rate of 65.5 cents.

IRS Mileage Rate for 2023 What Can Businesses Expect For The, Find out when you can deduct vehicle mileage. New york city is the only other city in the country with a minimum wage for food delivery drivers, at a rate of $17.96 per hour, which will increase to.

2022 Standard Mileage Rate / Fort Myers, Naples / MNMW, This is a special adjustment for the final six months of 2022. Beginning on january 1, 2024, the millage rate for reimbursement for business use will increase to 67 cents per mile.

IRS Standard Mileage Rates ExpressMileage, The internal revenue service (irs) recently announced the updated optional standard mileage reimbursement rates for 2023. In addition, the notice provides the.

IRS Announces 2024 Mileage Reimbursement Rate, California’s labor commissioner considers the irs mileage reimbursement rate to be “reasonable” for purposes of complying with lc 2802. You may also be interested in our free.

The irs bumped up the optional mileage rate to 67 cents a mile in 2024 for business use, up from 65.5 cents for 2023.